Base Case, noun phrase, the most likely or expected scenario when forecasting corporate financial performance.

Usage Note: Financial desk jockeys from buy-siders to investment bankers to corporate CFO’s use this term as part of their regular business of prognostication. It’s especially relevant during the grind show where the bankers and companies shamelessly stump for money to run their business (or rather, to waste on pet projects, diversifying acquisitions with “synergies”, or to pay a dividend to their Private Equity owners).

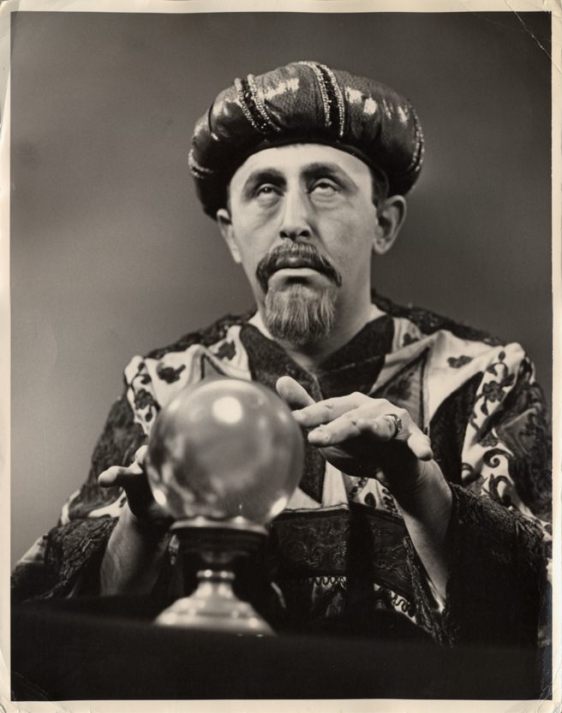

In the realms of High Finance, the business of forecasting is part and parcel of the job. Either you’re a CEO trying to convince investors your company will never see a downturn and can only grow year after year; or a banker trying to bamboozle the syndicate of “accounts” into thinking it’s normal that the company you’re hawking has an EBITDA forecast that looks like a “Hockey Stick”; or you’re a money manager trying to convince clients you can read the tea leaves and spot the canaries dying in the coal mine to ensure you make the best picks at the best times. Continue reading